Small and Medium Enterprises (SMEs) and Micro, Small, and Medium Enterprises (MSMEs) play a crucial role in driving economic growth and innovation. However, access to financing is often a significant challenge for these businesses. Whether you’re looking for an SME loan, MSME loan, or company loans to support your business operations, understanding your options and the application process is essential. In this detailed guide, we’ll explore various aspects of SME business loans, MSME business loans, and the importance of SME finance in empowering businesses. We’ll also discuss how to apply for MSME loans and what factors affect the SME loan interest rate.

Understanding SME and MSME Loans

SME loans and MSME loans are financial products specifically designed to meet the needs of small and medium-sized businesses. These loans provide the necessary capital for various business purposes, such as expanding operations, purchasing inventory, upgrading equipment, or managing cash flow. The terms SME finance and MSME finance refer to the broader range of financial services available to these businesses, including loans, credit lines, and other funding solutions.

Why SMEs and MSMEs Need Loans

SMEs and MSMEs often require external funding to fuel growth, innovate, or overcome short-term financial challenges. Here are some common reasons why businesses seek an SME loan or loan for business:

- Business Expansion: As a business grows, it may need additional capital to open new branches, enter new markets, or diversify its product offerings.

- Working Capital: Maintaining a steady cash flow is crucial for day-to-day operations. SME business loans can help bridge the gap between outgoing expenses and incoming revenue.

- Purchase of Equipment: Upgrading or purchasing new machinery, tools, or technology often requires significant upfront investment. Company loans can provide the necessary funds.

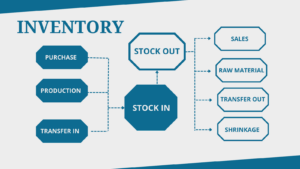

- Inventory Purchase: Stocking up on inventory, especially during peak seasons, can strain a business’s finances. Loans can ensure that the business is well-prepared to meet customer demand.

- Debt Consolidation: Businesses may use loans to consolidate existing debts into a single, more manageable payment, often at a lower interest rate.

Types of SME and MSME Loans

There are various types of loans available to SMEs and MSMEs, each designed to meet specific business needs. Understanding these options can help you choose the right loan for business:

- Term Loans: A term loan is a standard business loan where the borrower receives a lump sum upfront and repays it over a fixed period with interest. These loans can be used for various purposes, including expansion, equipment purchase, or working capital.

- Working Capital Loans: These are short-term loans designed to help businesses manage their day-to-day operations. They are ideal for covering expenses such as payroll, rent, and utilities.

- Equipment Financing: This type of loan is specifically used to purchase new or upgrade existing equipment. The equipment itself often serves as collateral for the loan.

- Invoice Financing: Also known as invoice discounting, this allows businesses to borrow money against their outstanding invoices. This is particularly useful for businesses that experience long payment cycles.

- Business Credit Line: A line of credit provides a business with access to funds up to a certain limit. The business can draw on the line of credit as needed and pay interest only on the amount borrowed.

- Trade Credit: Trade credit is a type of short-term loan extended by suppliers, allowing businesses to buy goods or services on credit and pay later.

- Government-Backed Loans: Many governments offer subsidized loans or guarantees to SMEs and MSMEs to encourage growth and innovation. These loans often come with favorable terms and lower interest rates.

How to Apply for an MSME Loan

Applying for an MSME loan or SME loan involves several steps. Understanding the process can increase your chances of approval and help you secure the best possible terms:

- Assess Your Needs: Before applying for a loan, determine how much financing you need and how you plan to use the funds. This will help you choose the right type of loan and lender.

- Check Eligibility Criteria: Different lenders have varying eligibility criteria for MSME loans and SME loans. Common requirements include a minimum business vintage (typically 1-3 years), a good credit score, and sufficient revenue or profit margins.

- Prepare Documentation: Lenders typically require several documents during the loan application process. These may include:

- Business registration documents

- Financial statements (balance sheet, profit and loss statement)

- Tax returns

- Bank statements

- Proof of ownership or lease agreements for business premises

- Details of collateral, if applicable

- Research Lenders: Compare different lenders based on their interest rates, loan terms, and fees. Consider both traditional banks and alternative lenders, such as fintech companies, which often offer faster approval times and more flexible terms.

- Submit the Application: Once you’ve chosen a lender, fill out the loan application and submit it along with the required documentation. Be prepared to answer any questions the lender may have about your business and its financial health.

- Review the Loan Offer: If your application is approved, the lender will provide a loan offer. Review the terms carefully, including the interest rate, repayment schedule, and any fees. Ensure that the loan terms align with your business’s cash flow and repayment capacity.

- Accept the Loan and Disbursement: After accepting the loan offer, the funds will be disbursed to your business account. Make sure to use the funds as planned and keep track of your repayments to avoid penalties.

Understanding SME Loan Interest Rates

The SME loan interest rate is a critical factor to consider when applying for a loan. Interest rates can vary widely depending on the lender, the type of loan, and the borrower’s creditworthiness. Here’s what you need to know:

- Fixed vs. Variable Rates: Some loans come with a fixed interest rate, meaning the rate remains constant throughout the loan term. Others have a variable rate that can fluctuate based on market conditions. Fixed rates offer stability, while variable rates may be lower initially but come with the risk of rising over time.

- Factors Influencing Interest Rates:

- Credit Score: Businesses with a strong credit history are more likely to secure loans at lower interest rates.

- Loan Amount and Term: Larger loans or those with longer repayment periods may come with higher interest rates.

- Collateral: Secured loans, where the borrower provides collateral, generally have lower interest rates compared to unsecured loans.

- Negotiating Rates: It’s often possible to negotiate the interest rate with the lender, especially if you have a strong credit profile or are borrowing a significant amount.

Benefits of SME Finance

SME finance is essential for the growth and sustainability of small and medium-sized businesses. Here are some of the key benefits:

- Access to Capital: Financing allows businesses to invest in growth opportunities, such as expanding operations, entering new markets, or developing new products.

- Improved Cash Flow: Loans can help smooth out cash flow fluctuations, ensuring that the business can cover its expenses even during slow periods.

- Building Credit History: Successfully managing a business loan can help build a strong credit history, making it easier to secure financing in the future.

- Competitive Advantage: Access to capital can give SMEs and MSMEs the resources they need to compete with larger businesses, whether through marketing, innovation, or improved efficiency.

Conclusion

Securing an SME loan or MSME business loan can be a game-changer for small and medium-sized enterprises. Whether you need a loan for business expansion, equipment purchase, or working capital, understanding the different types of loans and the application process is crucial. By optimizing your approach and carefully considering the SME loan interest rate, you can find the best financing solution to meet your business’s needs. SME finance and MSME finance are powerful tools that can help your business thrive in a competitive market. If you’re considering applying for an MSME loan, take the time to research your options, prepare your application thoroughly, and choose a lender that aligns with your business goals.