Understanding the concept of elasticity of demand is crucial for businesses and economists to predict market behaviors and set pricing strategies effectively. This comprehensive guide dives deep into the various facets of demand elasticity, including price elasticity, cross elasticity, and their practical applications in today’s dynamic markets.

What is Price Elasticity of Demand?

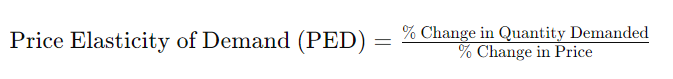

Price elasticity of demand measures how the quantity demanded of a good or service changes in response to a change in its price. Essentially, it answers the question: how sensitive are consumers to price changes? The formula used is:

A PED greater than 1 indicates that the demand is elastic, meaning consumers are highly responsive to price changes. Conversely, a PED less than 1 suggests inelastic demand, where price changes have little impact on the quantity demanded. Understanding this helps businesses set prices that maximize revenue without losing customers.

Defining the Price Elasticity of Demand

In simpler terms, the price elasticity of demand quantifies the relationship between price fluctuations and consumer demand. For example, luxury goods often exhibit higher elasticity because consumers can delay purchases or substitute with cheaper alternatives. On the other hand, necessities like food or healthcare generally show lower elasticity due to their essential nature.

Applications of Price Elasticity of Demand

The application of price elasticity of demand extends beyond academic theory into real-world business strategies:

- Pricing Strategy: Companies use elasticity to determine optimal pricing. For elastic goods, slight price reductions can lead to significant increases in volume, enhancing overall revenue.

- Revenue Forecasting: By understanding elasticity, businesses can predict changes in revenue resulting from price adjustments, aiding in more accurate financial planning.

- Market Analysis: Elasticity metrics help identify consumer preferences and market trends, informing more targeted marketing and product development strategies.

Discussing Price Elasticity of Demand

The discussion around price elasticity is not just about understanding how it works but also about applying it to various market conditions. For instance, during economic downturns, consumers may become more price-sensitive, increasing the elasticity of non-essential goods. Companies must adapt their strategies accordingly to maintain profitability.

Cross Elasticity of Demand

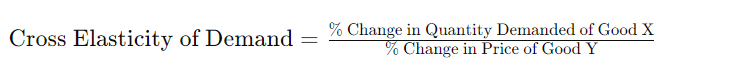

While price elasticity focuses on one product, cross elasticity of demand measures how the quantity demanded of one good changes in response to the price change of another good. It is expressed as:

This measure is crucial for understanding substitute and complementary relationships between products. For example, an increase in the price of butter may increase the demand for margarine, indicating a positive cross elasticity.

Calculating Cross Elasticity of Demand

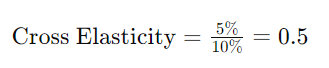

To calculate the cross price elasticity of demand, consider this scenario:

- The price of tea increases by 10%

- The demand for coffee (a substitute) increases by 5%

The cross elasticity would be:

This positive cross elasticity indicates that tea and coffee are substitute goods.

Application of Elasticity of Demand

The broader concept of elasticity of demand also includes applications like:

- Tax Incidence: Understanding which market side (consumer or producer) will bear the cost of a tax largely depends on the relative elasticities of demand and supply.

- Public Policy: Governments use elasticity to predict how excise taxes or subsidies affect consumption and allocate resources efficiently.

Conclusion

The study of elasticity of demand offers invaluable insights into consumer behavior and market dynamics. By mastering this concept, businesses can craft more effective pricing strategies, anticipate market changes, and enhance their competitive edge. As markets evolve, the continuous analysis of demand elasticity remains a key tool in the arsenal of savvy marketers and economists, driving informed decision-making and strategic planning.